Is the Indian Rupee Really That Weak? A Closer Look

The Indian Rupee (INR) has often been portrayed as a weak currency, but the reality might be different than what many believe. Over the past two decades, the INR has shown remarkable resilience against the US Dollar (USD) compared to its historical performance.

Understanding the INR’s Fluctuations

Like any other currency, the value of the INR fluctuates constantly based on supply and demand. The forex market, where currencies are traded, is heavily influenced by speculation about future demand and supply.

Several factors affect the INR-USD exchange rate:

- Foreign Capital Inflows and Outflows: Large investments into India (like by foreign institutional investors) strengthen the Rupee, while investments flowing out weaken it.

- Exports and Imports: A strong export market generally supports the Rupee, while a high import reliance can put downward pressure on it.

A Historical Look at the Rupee’s Performance

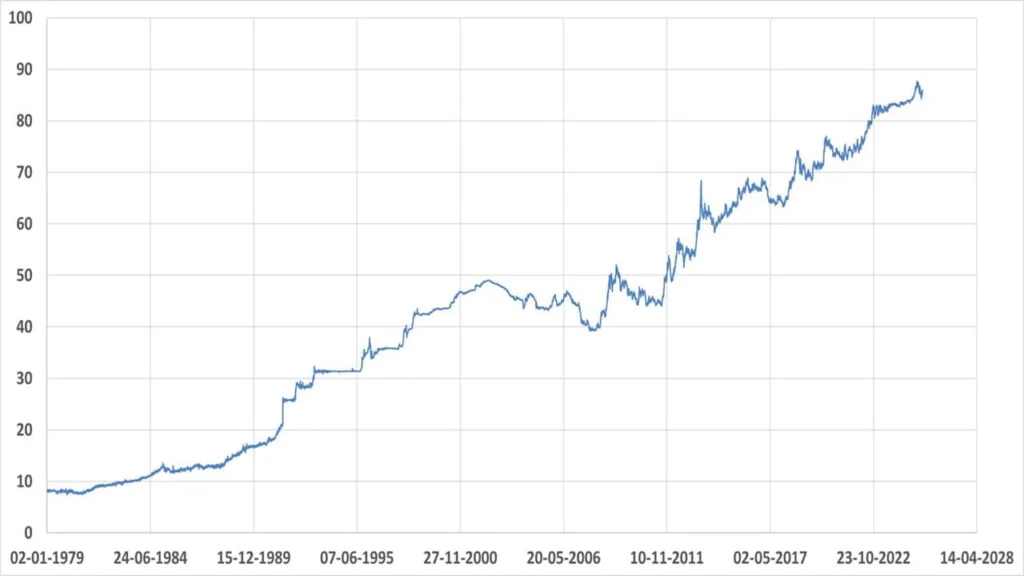

Historically, India has been a net importer, leading to a gradual depreciation of the Rupee against the USD. However, recent trends show a significant improvement. The magnitude of drawdowns in the exchange rate has decreased, indicating greater stability.

Looking at long-term rolling returns (over 5, 10, 15, and 20 years), the INR has demonstrably strengthened over the past two decades. This positive trend is expected to continue as India’s economy grows.

The Future of the INR

While India might not become a net exporter overnight, its export sector is projected to expand significantly, further stabilizing the INR. The global landscape is also shifting with the rise of BRICS nations. This could potentially reshape the world order and influence the dominance of the USD in the future, potentially benefiting the INR.

Final Thoughts

The Indian Rupee has weathered many storms and emerged stronger. Don’t let negative narratives fool you. The INR is on a positive trajectory, and its future looks bright.